The ImaginBank app from La Caixa is used for much more than seeing the money in your account, payments, and income. It has interesting options, such as sharing expenses, sending money through Bizum, buying discounted products, etc. Here we tell you five tricks you should know to get the most out of the ImaginBank app and do things you could only do at the bank until now.

SPLIT EXPENSES FROM THE APP

A very useful function if you organize a trip, a dinner, or a meeting with friends. ImaginBank has a feature that allows you to create a group of users to split expenses automatically. This way, you will know who owes their part or how much each person has to pay.

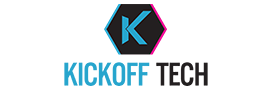

This feature is called Imagin & Split and can be found on the app’s home page. When entering the function, it will ask us to confirm our telephone number. Afterward, a window will open with the Imagin & Split main page, where we can create a group or enter an invitation code.

We must add the invitation code if someone has already created a group. To create a group and divide expenses, click ‘Create Group’ and enter a name and a category. The second step is to add participants. Of course, they must have the ImaginBank app so they can enter.

Once the group is created, we can add expenses and divide them among the members. The app automatically divides the expense and shows who has paid or owes their share. The total expense, the count, or what remains to be paid will also appear.

HOW TO VIEW RECEIPTS IN IMAGINBANK

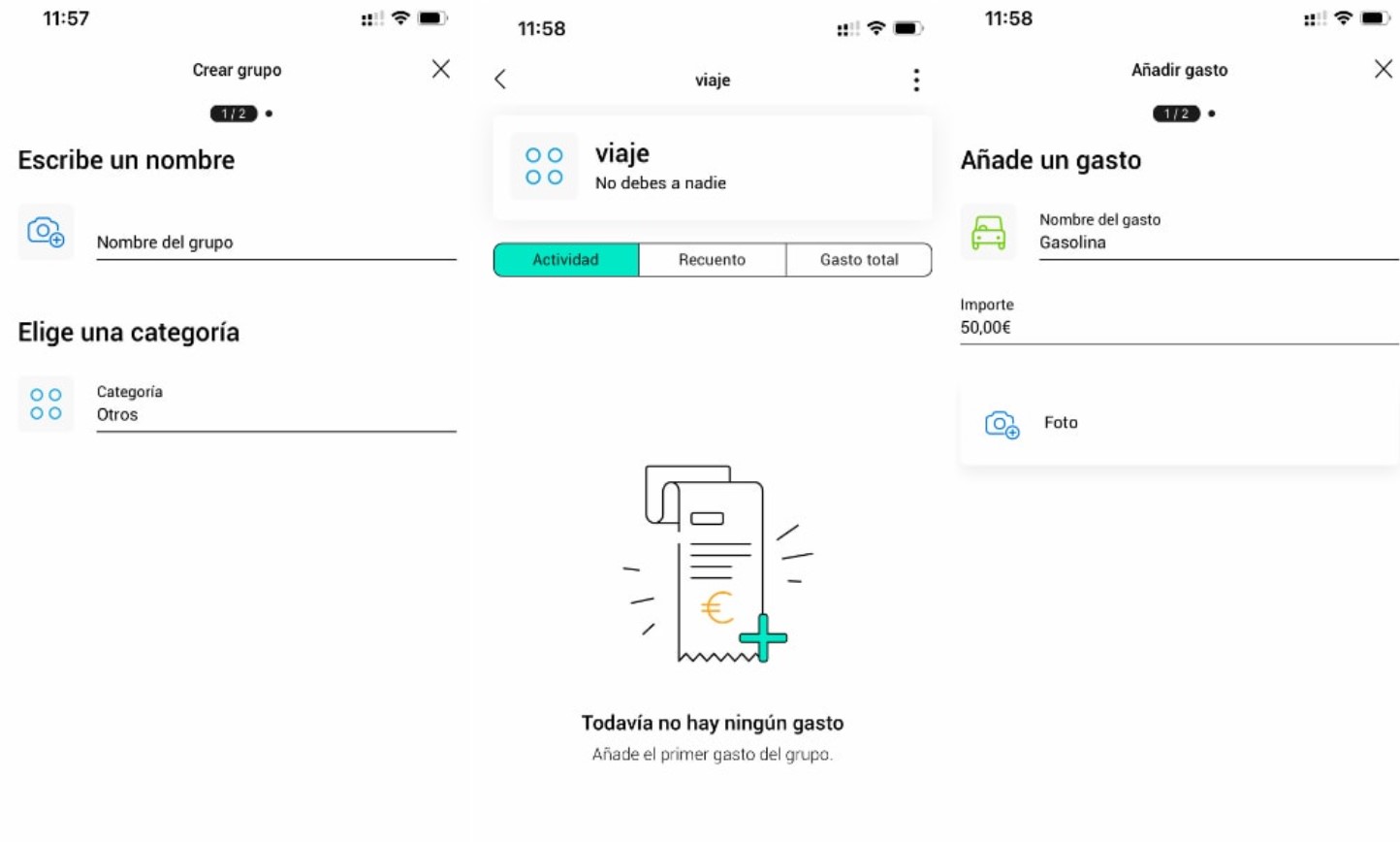

At ImaginBank, you can check payment and transfer receipts in the same way as if you did from the window or cashier. Of course, they are somewhat hidden, but I will show you how to consult and share them here.

First, go to the ImaginBak app and the ‘Products’ tab. Then, click on the option that says ‘Manage your receipts.’ The receipts for the last few months will appear there. Click on one of the payments to open the detailed information. Next, click on the three dots that appear in the upper area. Click ‘View receipt.’

A new tab will open with the image of the CaixaBank receipt. In the upper area, we can share it and send it in PDF format via email, WhatsApp, etc.

We can also return an erroneous receipt or cancel the direct debit from the Manage your receipts’ option.

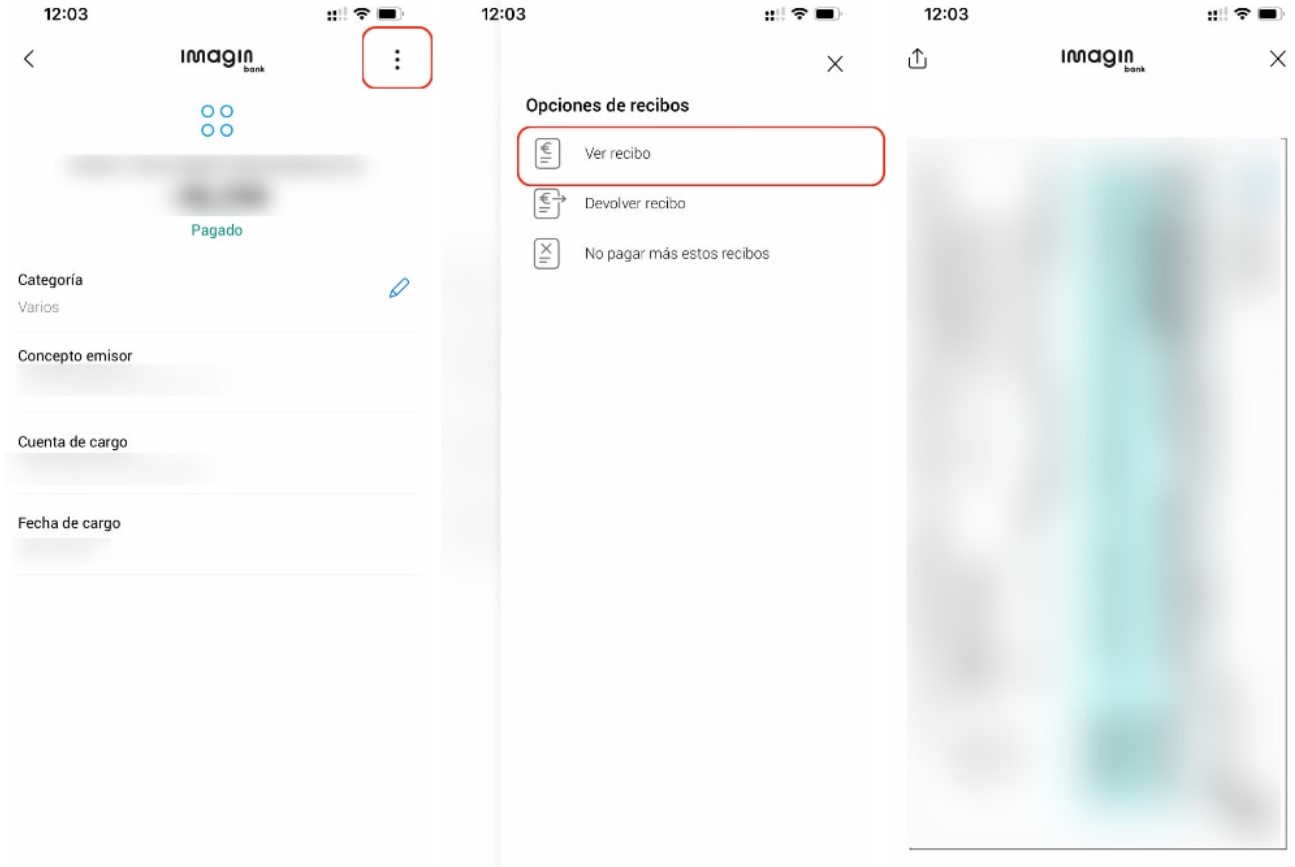

WITHOUT YOUR CARD AT HAND? SO THEY CAN CHECK THE DATA FROM THE APP

Have you ever wanted to buy something online without a card? Although browsers offer auto-filling card details, some boxes, such as the expiration date or the security code, must be entered manually. You may not remember your card’s code or expiration date, but you can easily see it from the ImaginBank app. I’ll tell you how.

First, enter the app and access the ‘Wallet’ section. Then, click on one of the cards you usually use to make purchases. Next, click on the first icon, where the last four digits of the card appear. When the new window opens, click the ‘+ info’ button on the right side.

The information will open, and part of the card number will appear. You can click on ‘Show content’ to see all the numbers. Swipe from the right to the left to check the security date or CVV data. The app will ask you to enter a code received via SMS. Once applied, you will receive a new message with the card details.

The message will show the verification code and the expiration date for you to enter the data in the online store. As simple as that.

HOW TO APPLY FOR CUSTOMIZED LOANS

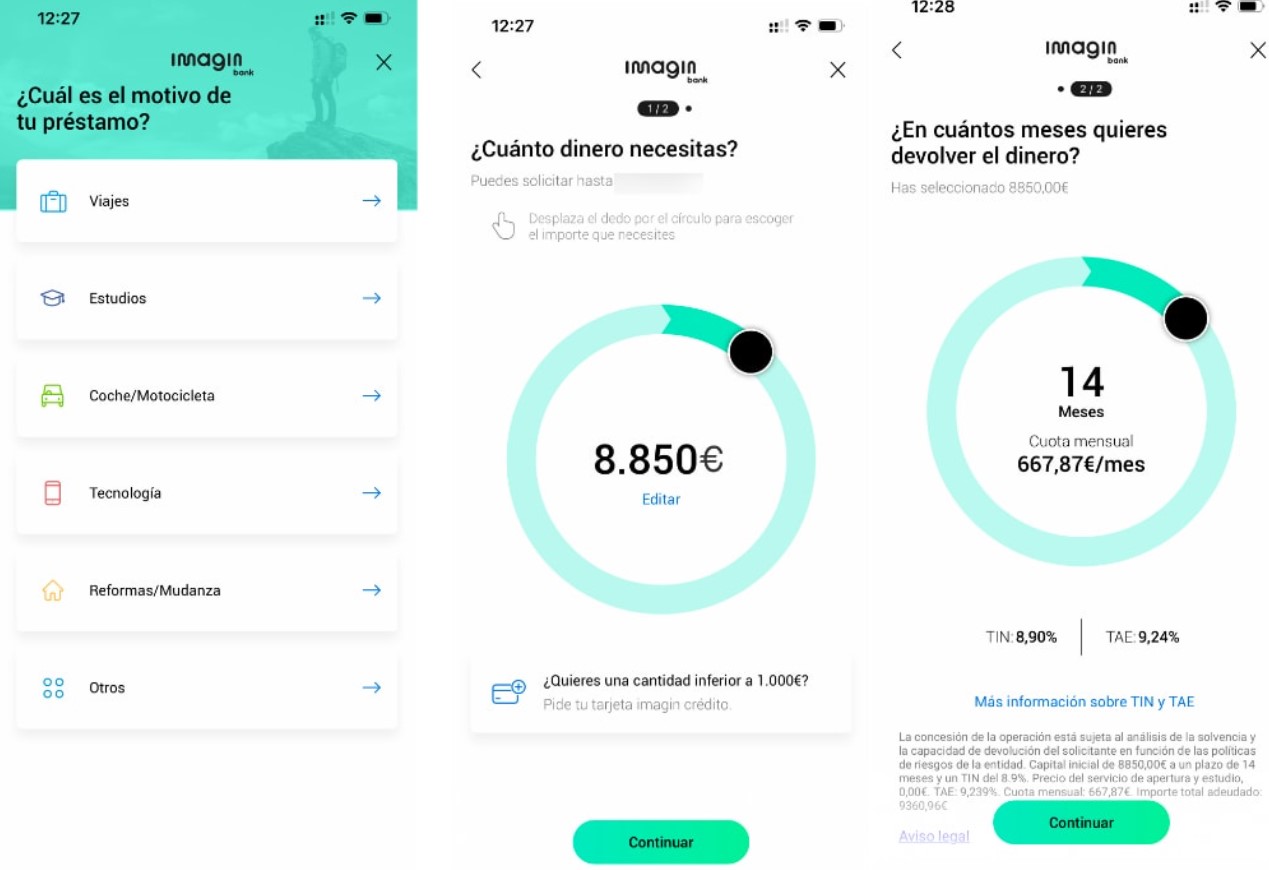

If you have an ImaginBank account, going to a La Caixa office is unnecessary to request a loan. From the app, you can request custom. We can customize the money we want and the number of installments to return it.

To request a customized loan, go to ImaginBank and click the ‘Products’ tab. Next, enter the section ‘We finance your dreams’ section and click ‘Custom loan.’ Now, you only have to select the reason for the loan, the amount, and the number of months you want to pay. For example, for six months, 24 months, etc.

You can also apply for an immediate loan through Imagin & Go. This option is perfect for smaller loans. It also lets you choose the installments and instantly receive the money. Depending on income and payroll, the maximum amount may vary.

HOW TO WITHDRAW MONEY FROM THE ATM WITHOUT THE NEED FOR A CARD

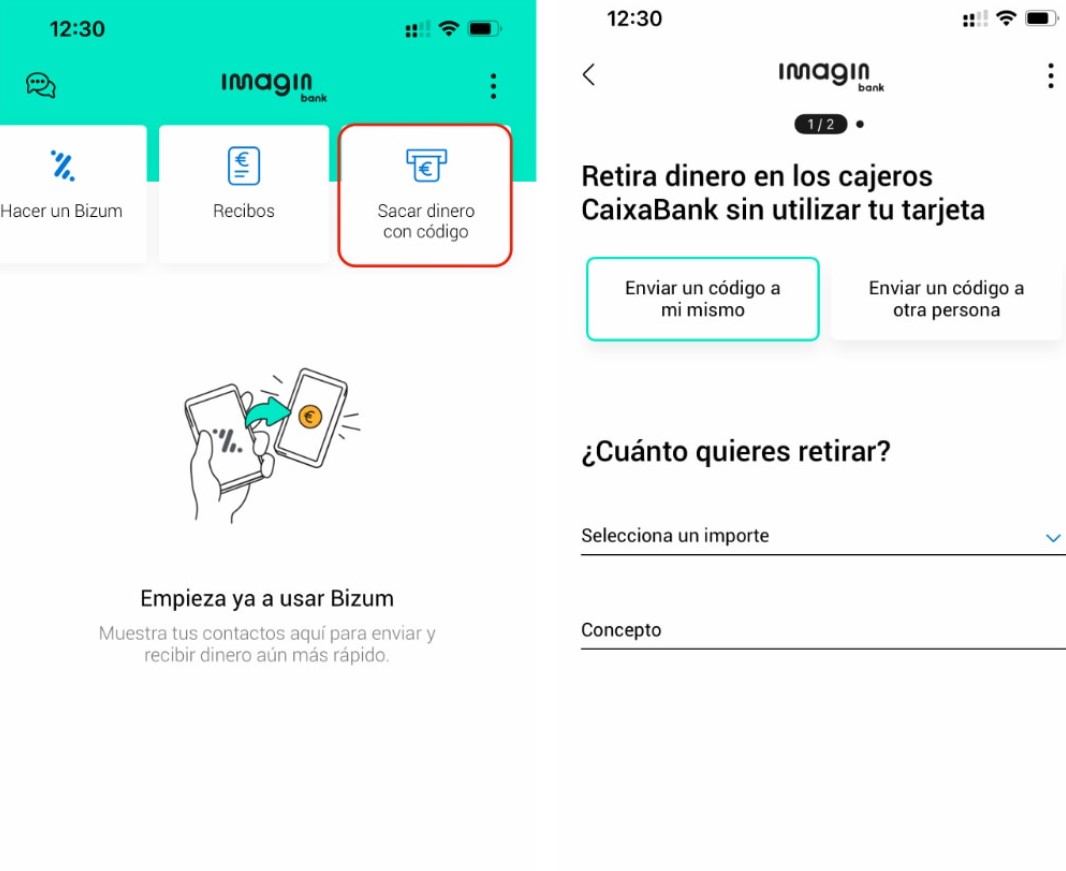

Do you need money, but you don’t have your card at hand? ImaginBank has the option to be able to withdraw money from the ATM without the need for our card, just with a code.

This option is found within the app in the ‘Payments’ tab. You must go to the ‘Withdraw money with code’ button. Next, select the amount and concept. A code will be created that you will receive by SMS. Go to a La Caixa ATM, and on the screen, click on the button to withdraw money with a code.

In addition to being able to withdraw money without a card, it is very useful if you need to lend money to a friend or family member. You can send him the code via message so that he can withdraw the amount you have marked at a La Caixa ATM. To do this, you must select the ‘Send a code to another person’ button and enter the phone number and the amount. When the user withdraws the money from the ATM, the expense will appear in our Imagin account. If you do not use the code, it will expire, and the transaction will be void.

I am a writer with eight years of experience writing in business and technology. I always carry a passion for learning and discovering new knowledge.